DewaTogel adalah situs permainan online terbaik dengan game yang lengkap dan sangat terpercaya. Situs ini menyediakan permainan judi seperti Permainan Togel Online , slot online, sportsbook dan betting live casino. Link situs game ini selalu siap menemani 24 jam nonstop setiap harinya tanpa ada jam Offline.

Situs Togel ini juga menyediakan berbagai fitur menarik yang memudahkan dalam setiap permainan para user di dalam game play situs kami. Namun bukan hanya situs ini memberikan pengalaman bermain yang seru menarik dengan server terbaik dan layanan profesional serta sisitem permainan yang sangat berkualitas di semua permainan yang tersedia.

Kalau kamu sedang mencari tempat bermain togel online dan slot yang benar-benar terpercaya, DewaTogel adalah jawabannya. Situs ini bukan cuma tempat buat tebak angka hoki, tapi juga jadi rumah bagi para pecinta toto slot gacor yang ingin merasakan sensasi menang besar setiap harinya. Dengan tampilan yang simpel, sistem yang cepat, dan keamanan yang terjamin, DewaTogel berhasil jadi salah satu situs favorit bagi pemain togel dan slot di Indonesia.

🌟 Prediksi Togel Online Paling Akurat dan Mudah Dimengerti

Salah satu daya tarik utama dari DewaTogel adalah fitur prediksi togel online yang disajikan secara lengkap dan mudah dipahami, bahkan oleh pemain pemula. Setiap prediksi disusun berdasarkan data keluaran sebelumnya, tren angka, serta analisis yang cukup detail. Jadi, kamu bisa punya gambaran lebih jelas sebelum menentukan angka taruhan. Bukan cuma soal hoki, tapi juga ada unsur strategi dan logika yang bikin permainan terasa lebih seru dan menantang.

Selain itu, DewaTogel juga menyediakan berbagai pasaran togel resmi seperti Singapore, Hongkong, Sydney, dan Macau yang selalu update setiap harinya. Semua hasil keluaran dijamin valid dan bisa dicek secara langsung, sehingga pemain tidak perlu khawatir soal keaslian data. Dengan begitu, kamu bisa menikmati permainan togel dengan rasa aman dan nyaman tanpa takut ditipu.

🎰 Toto Slot Gacor Paling Seru dan Menguntungkan

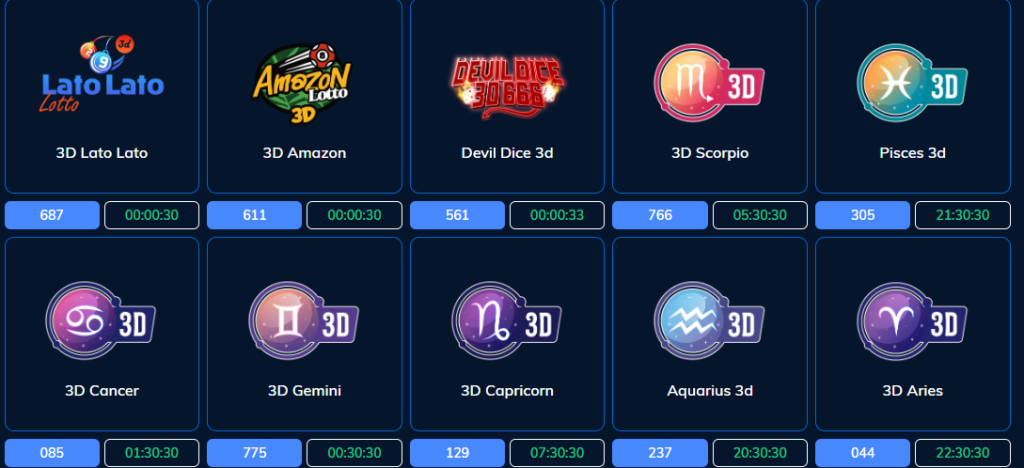

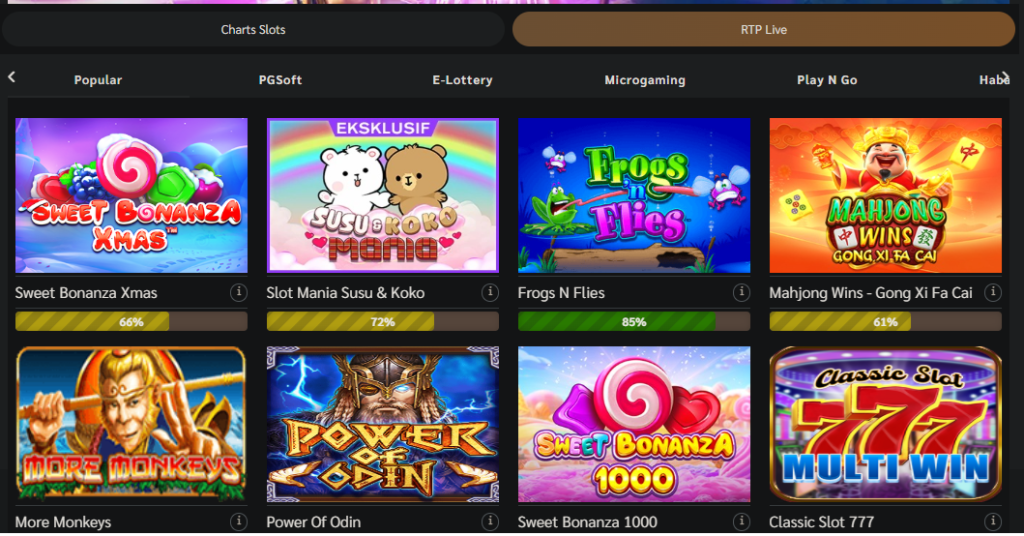

Selain togel, DewaTogel juga dikenal dengan koleksi permainan slot online gacor yang bikin betah. Ada ratusan game slot dari provider ternama seperti Pragmatic Play, Habanero, PG Soft, dan Joker123 yang siap kasih pengalaman bermain penuh keseruan. Banyak pemain yang mengaku sering dapat maxwin alias jackpot besar di sini, karena RTP (Return to Player)-nya tinggi dan peluang menangnya besar.

Buat kamu yang suka main santai, slot di DewaTogel juga bisa dimainkan dengan modal kecil tapi tetap punya peluang menang besar. Setiap permainan punya tema yang unik, efek visual yang keren, dan gameplay yang mudah dimengerti. Jadi, baik pemain baru maupun lama bisa langsung paham cara mainnya tanpa ribet.

💳 Transaksi Cepat, Aman, dan Bebas Ribet

DewaTogel juga memanjakan pemainnya lewat kemudahan transaksi. Situs ini sudah mendukung berbagai bank besar Indonesia seperti BCA, BRI, BNI, Mandiri, hingga CIMB Niaga, serta bank digital seperti Jago dan SeaBank. Proses deposit dan withdraw berlangsung otomatis dan bisa dilakukan kapan saja tanpa batas waktu. Jadi, kamu bisa bermain kapan pun kamu mau tanpa terganggu masalah teknis.

Link Alternatif Resmi DewaTogel Terverifikasi

Link Alternatif DewaTogel sangat penting untuk akses cepat dan tanpa hambatan. Itulah kenapa kami menyediakan link alternatif resmi yang telah diverifikasi keamanannya. Link ini dirancang untuk membantu pemain tetap terhubung dengan platform meskipun terjadi gangguan pada domain utama. Kami berpengalaman mengelola trafik tinggi dan selalu menjaga stabilitas koneksi agar pengalaman bermain tetap lancar. Link alternatif ini selalu diperbarui oleh tim teknis internal yang berpengalaman.

Link Alternatif : https://drugstore.us.org/

Alternatif deawtogel : https://tautin.app/S6M7RpGP48

CS Online 24 Jam Profesional

DewaTogel memiliki tim layanan live chat yang aktif 24/7 dan dilatih secara profesional. Tim kami bukan sekadar admin, tapi tenaga support yang paham teknis dan semua tentang kebutuhan pemain ataupun kendala dalam setiap proses bermain. Setiap pertanyaan soal deposit, withdraw, hingga kendala login akan dijawab dengan solusi, bukan template. Hal ini menunjukkan komitmen kami dalam membangun kepercayaan pengguna situs Togel Online ini dengan menghadirkan bantuan yang cepat, ramah, dan aktif. Adapun khusus bagi member VIP dapat langsung di hubungi oleh customer service terbaik kami.

RTP & Zona Resmi dari Provider Asli

Kami mengutamakan keadilan dan transparansi. Karena itu, RTP Slot DewaTogel selalu ditampilkan secara terbuka dan berasal dari provider game resmi. Kami tidak pernah memodifikasi sistem rtp karena seluruh game berjalan dalam server milik provider. Pengalaman pengguna kami tunjukkan bahwa akses pada data RTP meningkatkan kepercayaan pemain dan membantu mereka bermain lebih strategis. Sitem Zona menghadirkan Konten seputar permainan yang sangat membantu para pemula untuk memulai bermain di setiap

Panduan Deposit & Withdraw Cepat

Kami tahu bahwa waktu transaksi yang cepat adalah segalanya dalam dunia transaksi digital. DewaTogel menyajikan jadwal bank offline yang diperbarui secara real-time, agar setiap pemain bisa mengatur waktu deposit dan penarikan dengan tepat. Informasi ini selalu disesuaikan dengan jadwal resmi dari pihak bank, sehingga Anda bisa menghindari penundaan yang tidak perlu.

Cek terlebih dahulu akun bank kami yang aktif sebelum transfer.

Kami tidak pernah mengirimkan REKENING DEPOSIT melalui SMS, EMAIL ataupun di website ini. Deposit adalah mengirim uang ke rekening kami yang tersedia untuk ditukarkan menjadi CHIPS permainan. Bagaimana cara melakukan deposit?

- Deposit hanya dapat diproses selama BANK ONLINE.

- Jika BANK SEDANG OFFLINE atau BANK SEDANG GANGGUAN semua proses deposit tidak dapat diproses untuk sementara waktu sampai BANK KEMBALI NORMAL.

- Harap perhatikan rekening deposit kami yang sedang aktif sebelum melakukan pengiriman deposit, sehingga deposit anda dapat di proses secepatnya ke dalam dompet utama anda.

- Jika anda ingin lancar dalam proses DEPOSIT harap mengirim dana dalam angka unik di setiap deposit. Contoh : Rp. 500.879, Rp 50.247, Rp. 84.987 dan sebagainya. Ini berguna untuk kami melihat secara cepat deposit anda.

- Jika deposit anda telah diproses tapi chip anda belum bertambah harap menghubungi Customer Service kami melalui LIVECHAT.

Game Lengkap: Togel, Slot, Casino, Poker, Sbobet

Dengan pengalaman lebih dari 10 tahun di dunia permainan togel online, situs kami menyediakan seluruh game favorit hanya dalam satu akun. Pemain bisa memilih antara togel, slot, live casino, poker IDN, atau taruhan bola Sbobet. Semua game dijalankan melalui penyedia resmi dengan provider yang sudah bekerja sama lebih dari puluhan tahun, memastikan sistem yang aman dan diawasi oleh lisensi langsung PAGCOR. Komitmen kami adalah menyediakan hiburan yang terpercaya, bukan hanya janji. Situs online resmi ini memiliki berbagai game permainan favorit di Link DewaTogel menyediakan :

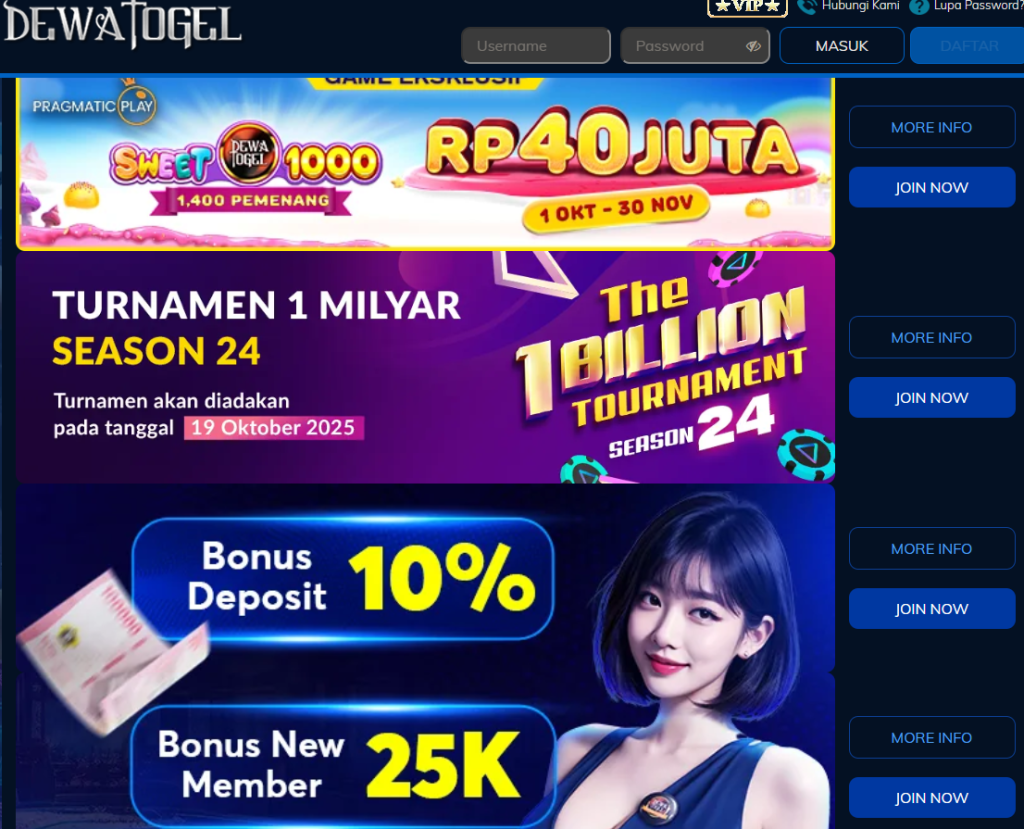

Promo & Bonus Harian Menarik

DewaTogel tidak hanya fokus pada fitur, tapi juga memberikan bonus harian dan promosi yang nyata. Setiap promo kami disusun dengan syarat yang jelas dan tidak menyesatkan. Pengguna dapat membaca detail program melalui halaman khusus dan menu promosi yang terus kami perbarui. Pengalaman pemain menunjukkan bahwa bonus event ini membantu meningkatkan modal bermain dengan cara yang fair dan berimbang.

ZONA DEWATOGEL

Zona DewaTogel adalah fitur khusus yang dibuat untuk memberikan pengalaman bermain yang lebih terarah dan nyaman bagi setiap member. Di dalam zona ini, pemain bisa menemukan berbagai kategori permainan seperti togel, slot, live casino, dan game tembak ikan, semuanya tertata rapi agar mudah diakses. Setiap zona punya tampilan dan suasana yang berbeda, jadi kamu bisa memilih area permainan sesuai selera apakah ingin fokus menebak angka, atau sekadar bersantai dengan permainan slot ringan.

Selain itu, Zona DewaTogel juga dilengkapi dengan berbagai fitur tambahan seperti informasi pasaran togel terkini, daftar pemenang harian, serta promo dan bonus eksklusif yang hanya tersedia di dalam zona tertentu. Dengan konsep ini, DewaTogel ingin memberikan sensasi bermain yang tidak monoton dan selalu fresh setiap kali kamu login. Intinya, Zona DewaTogel bukan sekadar tempat bermain, tapi juga ruang hiburan online yang penuh kejutan.

🤝 Program Referral DewaTogel

Program Referral DewaTogel adalah cara paling mudah buat kamu dapat penghasilan tambahan tanpa harus bermain. Cukup bagikan link referral kamu ke teman, saudara, atau komunitas online, dan setiap kali mereka mendaftar serta aktif bermain di DewaTogel, kamu akan mendapat komisi otomatis dari aktivitas mereka. Semakin banyak teman yang kamu ajak, semakin besar juga potensi pendapatan pasif yang bisa kamu nikmati setiap hari.

Yang menarik, sistem referral di DewaTogel ini transparan dan real-time. Kamu bisa melihat langsung jumlah referral, total bonus yang masuk, dan riwayat transaksi lewat dashboard akunmu. Tidak ada batasan jumlah teman yang bisa kamu undang, jadi kesempatan untuk cuan terbuka lebar. Program ini jadi bukti kalau DewaTogel bukan cuma tempat bermain, tapi juga peluang untuk membangun penghasilan tambahan dengan cara yang simpel dan menyenangkan.

📲 Cara Download Aplikasi DewaTogel di App Store & Play Store

- Buka App Store (iPhone) atau Play Store (Android) di ponsel kamu.

- Ketik “DewaTogel” di kolom pencarian.

- Tekan Install untuk mengunduh dan memasang aplikasi.

- Setelah terpasang, login menggunakan akun yang sama seperti di situs utama.

- Nikmati semua fitur togel dan slot favorit langsung dari aplikasi tanpa perlu buka browser.

- Keunggulan aplikasi:

- Ringan, cepat, dan aman.

- Tersedia notifikasi bonus & update hasil togel langsung di ponsel.

- Tampilan responsif dan nyaman untuk layar smartphone.

- Bisa dimainkan kapan pun dan di mana pun tanpa gangguan.

💳 Cara Deposit di DewaTogel

- Login ke akun DewaTogel kamu.

- Pilih menu Deposit di dashboard utama.

- Tentukan metode pembayaran, bisa lewat:

- Bank lokal: BCA, BNI, BRI, Mandiri.

- Bank digital: Jago, SeaBank, dan lainnya.

- Masukkan nominal deposit sesuai keinginanmu.

- Ikuti petunjuk transfer yang muncul di layar.

- Tunggu beberapa detik saldo otomatis masuk ke akun kamu.

- Kelebihan sistem deposit DewaTogel:

- 100% otomatis dan aman tanpa perlu kirim bukti manual.

- Berjalan 24 jam, bisa deposit kapan saja.

- Transaksi cepat, langsung siap bermain tanpa menunggu lama.

Pertanyaan yang Sering Diajukan di Bandar Taruhan Dewatogel

Apakah Dewatogel Terpercaya?

Jawabannya: Ya, 100% Aman & Profesional

Dewatogel telah membuktikan reputasinya sebagai platform judi online yang kredibel dan terpercaya di Indonesia. Beroperasi sejak lama dan mengantongi lisensi resmi dari lembaga pengatur internasional, Dewatogel menjamin setiap aktivitas permainan dan transaksi berlangsung secara adil dan aman.

✅ Transparansi penuh dalam proses deposit dan penarikan

✅ Diaudit secara berkala oleh pihak ketiga independen

✅ Sistem keamanan data tingkat tinggi (enkripsi dan perlindungan privasi)

✅ Layanan pelanggan responsif 24 jam yang siap membantu kapan saja

Dengan komitmen terhadap keadilan dan keamanan, Dewatogel tidak hanya dipercaya oleh ribuan member aktif setiap hari, tapi juga terus berkembang sebagai salah satu situs judi online terbaik di Asia Tenggara.

🔒 Main dengan tenang, karena di Dewatogel – keamanan dan kepercayaan adalah prioritas utama!

Apakah Bermain di Dewatogel Aman?

Tentu, Keamanan adalah Prioritas Utama!

Di Dewatogel, keamanan pemain adalah segalanya. Untuk melindungi data pribadi dan transaksi finansial, platform ini menggunakan teknologi enkripsi SSL 128-bit, setara dengan standar keamanan perbankan internasional.

🔐 Teknologi Enkripsi Canggih

Semua informasi yang Anda masukkan—mulai dari data login hingga detail transaksi—akan dienkripsi dan tidak bisa diakses oleh pihak tidak bertanggung jawab.

🛡️ Sistem Anti-Fraud & Verifikasi Ganda

Dewatogel menerapkan lapisan keamanan tambahan, seperti verifikasi identitas ganda dan sistem deteksi aktivitas mencurigakan, untuk mencegah pembobolan akun atau penyalahgunaan data.

📶 Pengawasan Real-Time & Server Aman

Seluruh sistem dipantau secara real-time oleh tim IT profesional dan disimpan di server berstandar tinggi, memastikan kestabilan dan perlindungan penuh saat Anda bermain.

✅ Hasilnya? Bermain di Dewatogel bukan hanya seru, tapi juga aman sepenuhnya.

Gabung sekarang dan nikmati pengalaman bermain dengan rasa tenang dan tanpa khawatir!

🔥 Kesimpulan

Secara keseluruhan, DewaTogel bukan hanya situs togel biasa, tapi juga platform hiburan lengkap yang menggabungkan prediksi togel, permainan slot gacor, dan layanan cepat dalam satu tempat. Dengan reputasi yang solid, sistem fair play, dan banyak pilihan permainan seru, DewaTogel layak jadi pilihan utama buat kamu yang ingin bermain aman, nyaman, dan tentu saja — berpeluang menang besar setiap hari.

RELATED POST DEWATOGEL

KEYWORD TERKAIT

angka 2d hk angka 4d hk angka keluar hk bocoran hk data hk data hongkong hasil hk hk pools hk togel hongkong pools hongkong pools live draw keluaran hk keluaran hk hari ini live draw hk live draw togel hongkong nomor hongkong pengeluaran hk pengeluaran hk hari ini prediksi hk prediksi hk malam ini result hk togel cambodia togel china togel hari ini togel hk togel hk live draw pool togel hongkong togel hongkong alam togel hongkong angka setan togel hongkong besok togel hongkong bg bona togel hongkong code syair togel hongkong datu sunggul togel hongkong ekor jitu togel hongkong fabiofa togel hongkong gaib togel hongkong guru togel hongkong jos togel jepang togel kingkongpols togel korea togel macau togel sgp togel sydney togel taiwan